|

Tuesday 1st April 2025 |

Text too small? |

Fool's gold

Global

The S&P500 turned around during the session on Monday as investors prepped for more clarity on Donald Trump’s “reciprocal” tariff plan, which will be unveiled at the White House Rose Garden on Wednesday. Tech stocks were mixed, but other names were in demand, including the traditional automakers. The President has said that the starting point will be “all countries” as opposed to those that are running large trade deficits with the US. The White House Press Secretary said overnight that there would be no exemptions, and the announcement would focus on countries as opposed to sectors. The Nasdaq fell 0.1%, while the Dow rallied 1% and the S&P500 rose 0.6%. Increasing trade uncertainties saw gold futures surge US$40 to a record US$3155 an ounce.

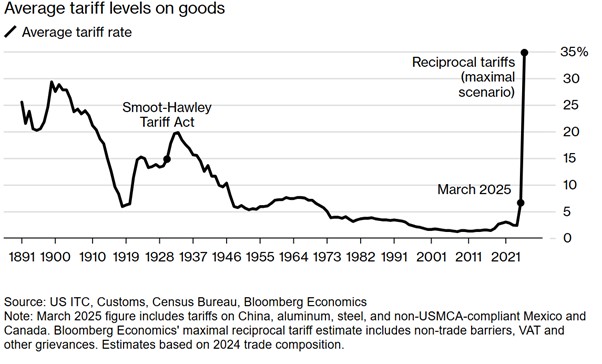

Developments on the tariff front have been somewhat difficult to keep up with, but as things stand there are duties already in effect, with 25% on steel and aluminium imports to the US, 20% on Chinese goods, 10% on Canadian energy, and 25% on goods from Mexico and Canada not in compliance with the free-trade agreement negotiated in 2020 (a deal claimed as a “bad one” by Trump, despite that fact he was the one who signed it during his first term).

In terms of scheduled tariffs, 25% tariffs are coming in on auto parts from April 2, along with the same duties for any countries buying Venezuelan oil. The bigger focus however is the “country-based tariffs” which are set to be unveiled on Wednesday. Treasury Secretary Scott Bessent has previously singled out the “Dirty 15” countries that account for most of America’s trade deficit would be targeted, but it seems the net will be much wider. Donald Trump for one has an issue it seems with those countries that charge value-added taxes (this includes GST) which he sees as an unfair trade practice. The grievance ignores the fact that these taxes are not targeted and apply equally to U.S. and foreign products. More than 170 countries worldwide employ value-added taxes.

Newton’s third law effectively states that every action has an equal and opposite reaction, and the implementation of tariffs by the US will not come without a reaction from trading partners, but also the US economy. Goldman Sachs has cautioned that aggressive tariffs could raise inflation and severely slow economic growth. The investment bank has raised its forecast for US inflation this year to 3.5% (from 3%), cut its GDP growth outlook to 1% (from 1.5%), and raised its unemployment estimate to 4.5% (from 4.2%). Goldman’s now sees a 35% chance of recession in the next 12 months, up from 20% in its prior outlook. The term “stagflation” (stagnant growth with elevated inflation) has certainly become more prevalent in terms of mentions in investor circles. Donald Trump has meanwhile described the economic “transformation” that is underway as “a beautiful thing to watch.”

The challenge that investors are dealing with is the uncertainty around the details, in terms of the quantum and application of the new tariffs and their timeframe. It is also therefore possible that the duties brought in are less punitive than those feared. This is also while the US economy in its current state remains in relatively good shape.

It remains to be seen whether Donald Trump’s strategy proves to be a master-stoke that delivers concessions from trading partners, or something far less beautiful. The stock market has cast its vote, with the S&P500 down around 6% in March and 9% since the record set in February. Gold prices are also showing another point of view of the President’s errand on tariffs – gold prices are at record levels and are up 20% so far this year.

The Dow has fallen 5% this month (but is down less than 2% this year) while the tech-heavy Nasdaq is down 8% and 15% from its all-time high set in December. Donald Trump (unlike last time around) seems less worried about his card being marked by the stock market’s performance. One of his closest allies has however noted the financial impact of the incoming administration’s policies. Elon Musk said that his involvement with the DOGE team is creating a backlash against Tesla, which “has been cut roughly in half.” Tesla shares were down another 1.7% on Monday.

The current market environment has unsurprisingly not been great timing for a tech IPO. Shares in AI cloud provider CoreWeave (the biggest tech float since 2021) fell 10% on its second day of trading. Not such a problem for old economy stocks it seems – shares in conservative cable news network Newsmax debuted on Monday with a gain of more than 700%. Newsmax is a competitor to Fox which has had its way for a long time as a Republican-leaning network.

One tech firm pushing ahead was United Microelectronics. The shares soared 9% on news that the Taiwan headquartered company is looking to potentially merge with GlobalFoundries. The merger would create a company based in the U.S with production capabilities in Asia, the U.S. and Europe and potentially become an alternative to Taiwan Semiconductor.

Pharma stocks were also in focus as the U.S. Food and Drug Administration’s top vaccine regulator resigned, criticising Robert F Kennedy Jr. for promoting “misinformation and lies” around immunisation. The recently anointed Health Secretary is a vaccine sceptic. Shares in Moderna fell 9%.

Across the Atlantic, the STOXX50 fell 1.6%. Ahead of Wednesday’s announcement, the EU has made an interesting point about average tariffs on EU-US trade. The average tariff rate on both sides is approximately 1%. In 2023, the US collected approximately €7 billion of tariffs on EU exports, and the EU collected approximately €3 billion on US exports – so not exactly a bad deal.

On the data front, German inflation came in at 2.3% in March, below forecasts for 2.4% and down from 2.6% in February. On a monthly basis, harmonized inflation rose 0.4%. Core inflation came in at 2.5%, below February’s 2.7% reading. Services inflation eased to 3.4% from 3.8% in the previous month. Eurozone inflation figures are out on Tuesday. It remains to be seen whether tariffs could also ultimately prove a disinflationary force for the eurozone if growth were to weaken and goods originally produced for the U.S. market are sold in Europe at a reduced price point. This is an argument that equally applies to other nations, including NZ.

In the UK, the FTSE100 fell 0.8%. Aston Martin was a feature, with the carmaker jumping 7%. The luxury carmaker said it will raise more than £52.5 million as a Canadian billionaire increases his stake, and as it sells a minority stake in the Formula One racing team for at least £74 million. Aston Martin remains committed to FI, but probably no chance for a move for Liam Lawson though – the team includes two-time world champion Fernando Alonso and the Chairman’s son.

In Asia, the Nikkei moved sharply lower, falling 4.1% with exporters, including big car makers, selling off. The index is now in correction territory, having fallen nearly 12% from its December high. The CSI300 in China held up better, falling 0.7%.

No comments yet

April 10th Morning Report

Why are bond yields soaring??

Devon Funds Morning Note - 09 April 2025

April 9th Morning Report

SUM - SALES OF OCCUPATION RIGHTS

April 8th Morning Report

April 7th Morning Report

MLN - NZX ADVISER FIRM HANDLING FEE ON MARLIN GLOBAL WARRANTS

THL - Preliminary Response to US Tariff Announcement

CDC Independent Valuation