Fat Prophets

|

Wednesday 23rd April 2014 |

Text too small? |

What’s new

Mirvac’s financial results for the recent December-half of 2013 provided further comfort to our positive view on the integrated landlord and property developer. The investment case continues to be underpinned, in the first instance, by the resilient passive income streams from the property trust side.

Augmenting this is the bright outlook for the Development division’s earnings which are set to step-up considerably in the next few years, driven by the quality of Mirvac’s residential offerings, the current strength of pre-sales and the impressive pipeline of projects still to come.

Outlook

Following the solid first half performance, management had no hesitation in tightening the fiscal 2014 earnings guidance, from a projected operating EPS range of 11.7-12.0 cents per share to 11.8-12.0 cents, translating to a year-on-year growth of 8-10 percent. This is hardly surprising given the robust operating metrics being generated from the core property trust division, with the 45 percent growth in pre-sales in the Development business and related project timing pointing to a much better result in the current June half.

Looking further out, the strength of pre-sales and the volume pipeline is such that not only is 92 percent of targeted Development EBIT for fiscal 2014 already in the bag, but 56 percent of the division’s projected profits are also pretty much secured.

All this supports our view that the Development business is set for a significant step-up in earnings, to potentially $170-190 million per annum at the EBIT level for the next 3 years, up from just $95 million in fiscal 2013. With Mirvac’s significant exposure to the robust NSW market and the generally strong positioning in the inner-city premium apartment space, the scene is certainly set for a bright future.

As for the core property trust or Investment division, resilient growth continues to be the key feature with like-for-like net operating income growth, occupancy and average lease expiry all at industry-leading levels. The diverse portfolio of quality assets across the office, retail and industrial sectors, leased to quality brand-name tenants, remains the passive income engine that underpins the entire Mirvac group.

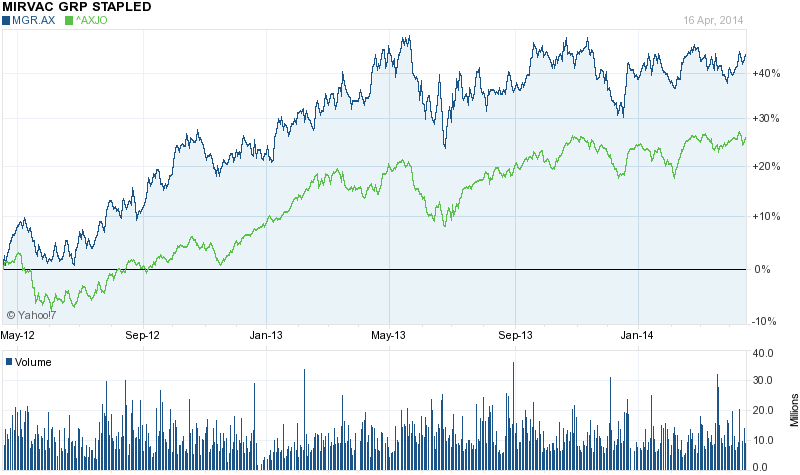

Price

Mirvac’s stock price has been stagnant in recent times, pretty much unchanged over the 12 months, although 8.9 cents per share in dividends have been paid in that time. The lack of action on the bourse is not surprising given the significant changes over the past 12-18 months, with a completely revamped senior management team (including CEO and CFO), a new Chairman and a $400 million capital raising conduced back in May 2013 to fund an acquisition. However, with the strategy set and a robust development pipeline, the outlook for Mirvac shares is positive, in our view.

Worth Buying?

We regard Mirvac one of the best risk-adjusted plays on the domestic residential market, particularly in New South Wales. We are also drawn to the group’s unique leverage to the structural trend towards more inner-city/metropolitan multi-dwelling living, with particularly strong demand from investors and offshore buyers. We see all these factors and the growing development pipeline driving a relatively low-risk high-single-digit percentage earnings growth profile for the next few years.

The stock is currently yielding 5.2 percent (albeit un-franked) and trades at 14.7 times consensus fiscal 2014 EPS estimates, falling to 14.2 times the following year. We view these as attractive multiples, and believe the stock is worth buying at current levels.

Greg Smith is the Head of Research at Fat Prophets.

To receive a recent Fat Prophets Report, call 0800 438 328 or Click here.

No comments yet

December 27th Morning Report

FBU - Fletcher Building Announces Director Appointment

December 23rd Morning Report

MWE - Suspension of Trading and Delisting

EBOS welcomes finalisation of First PWA

CVT - AMENDED: Bank covenant waiver and trading update

Gentrack Annual Report 2024

December 20th Morning Report

Rua Bioscience announces launch of new products in the UK

TEM - Appointment to the Board of Directors