By Anthony Quirk

|

Saturday 5th August 2006 |

Text too small? |

Ironically the markets seem to take some solace from the prospect of a slowing US economy leading to lower interest rate pressures. While this is true, it also means that there is increased risk of earnings falling short of expectations than was the case previously, particularly if the economic slow-down is more marked than expected.

Increased earnings risk is also a current theme for the New Zealand sharemarket with the domestic economy in slow-down mode on most measures. Previously the listed sector seemed to have avoided much of this. However, as the June half-year results start, more listed companies are making reference to a much tougher domestic operating environment. It may pan out as the Reserve Bank of New Zealand (RBNZ) expects, with export related industries benefiting from a weaker kiwi dollar but with most domestically-oriented companies “doing it tough”.

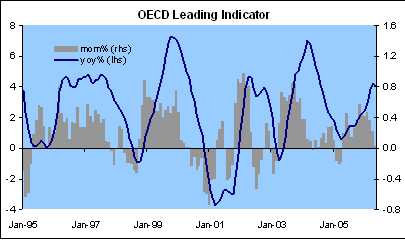

The widespread domestic economic easing is the driver behind the RBNZ leaving rates unchanged last week and they all but said the tightening cycle is expected to now be complete. They recognise that any further rate rise could result in a “hard landing” for the New Zealand economy and an almost inevitable recession. While not as explicit, the US Federal Reserve (the Fed) is likely to be also nearing the end of its tightening cycle with perhaps one more rate rise to go. This is due to higher interest rates and petrol pump prices and a housing market downturn starting to crimp consumer spending in that country.

Source: First NZ Capital

In the US the ending of the tightening cycle and the prospect of easing rates is usually a driver to significant share and bond market rallies. This was the case in the mid-1980s and mid-1990s. Could it be repeated now? It depends on whether the Fed goes one rate rise too many and trips the US into recession.

So just as in New Zealand, the US markets are currently hostage to Central Bank policy. To date the Fed has done a good job through the tightening cycle and if this continues, a case can be made for a significant rally in the US because:

In New Zealand the case for a rally on the back of a pause and then easing from the RBNZ is less compelling because our:

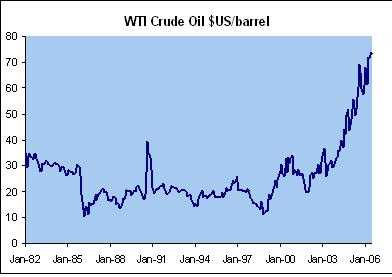

The wild card in all this is oil. The prospect of entrenched inflation from ongoing higher wage rise demands off the back of increased petrol costs is the main headache for Central Bankers around the world. To eliminate this risk Central Banks would have to raise rates and so a recession/stagflation scenario could unfold. So in many ways we are at a cross roads between an ugly stagflation outcome and a much more palatable rally induced by easing interest rates.

Oil could be the key to which road we go down. So what are the prospects for the oil price? I used to think that of all financial market variables currency rates were one of the hardest to pick. However, I now wonder if trying to predict oil prices has supplanted this! There are wildly divergent scenarios out there from experts in this area ranging from a return to the days of US$30 a barrel to a move beyond US$100 a barrel.

For now demand for oil is still strong. There is no doubt that China and other emerging economies have been key drivers. China already uses almost 1/3rd of US consumption levels (6 million barrels a day versus 20 million a day in the US). However, demand from China is growing much more quickly at about 0.5 million barrels a day each year versus growth of about 200,000 in the US. Some forecasters are predicting China will use 15 million barrels a day by 2030, with surging car sales a factor (up nearly 50% in China in the first half of 2006 alone).

The US has also contributed with record gasoline demand there in June. This is despite retail petrol prices hitting US$3 a gallon, near the inflation adjusted high of the early 1980s of $3.18. It does illustrate the strength of the global economy that demand for oil has been so seemingly unaffected by its strong price rise.

While many other commodities suffered a sell-off in May/June oil prices stayed strong suggesting they are under pinned at current levels and demand pressures are behind this. Until now the rise in oil prices has been driven mainly by demand factors (the China effect etc) but at present the world is extremely vulnerable to a supply side shock. Most of the world’s surplus capacity is currently in Saudi Arabia with very little excess from the other main producers.

While decelerating global growth will impact on oil prices, they may only slow the rate of increase rather than cause a significant reversal. It is hard to make a bearish case for oil, other than a prolonged global recession and/or a one-off shock such as bird flu. While both are not impossibilities, for oil the risks currently seem to be on the upside from continued demand pressures, with escalating Middle East conflicts being a wild card. With Iran the 5th largest oil producer it will probably continue to play on this from time to time given its nuclear aspirations. And of course we have the US hurricane season still to come this year!

On the positive side, according to the Paris-based International Energy Agency, OPEC’s idle crude oil capacity will reach 4.2-6.1 million barrels a day in 2011, up from about 2 million a day now. Looking further out than this, oil at these prices or even higher will be a spur to more exploration as well as new technologies and innovations to find alternatives. However, that looks a long way off at present and we all probably have to get used to higher oil prices in the interim.

So unless something unexpected happens there is unlikely to be any “easy out” for Central Banks from falling oil prices. Instead they will have to earn their money and carefully balance the risks of global recession with stagflation. The role of the Central Banker is never easy with economic and market commentators constantly second guessing them and saying what they should have done with the benefit of hindsight. However, it is a particularly difficult role at present as the global economy decides which road (recession/stagflation or non-inflationary growth) to go down.

To see how the numbers stacked up for various markets around the world in the past month and over the year, visit our Monthly Market Review here

Anthony Quirk is the managing director of Tyndall Investment Management New Zealand Limited (Tyndall).

No comments yet

Opinion: Sorry Feltex saga has damaged reputations and confidence

Opinion: Commission investigation into Plus SMS will test credibility

Market Review: US housing downturn a warning for New Zealand?

Opinion: Government wants better co-ordination between regions

Opinion: A flutter on Sky City shares may become more of a gamble

Opinion: Slowdown? What slowdown? Economic data tells two stories

Opinion: Electricity investment uncertainty after mixed messages

Opinion: This will transform the economy won't it? Yeah right

Opinion: Sharemarket performance as bleak as the weather

Opinion: Outcry grows as council rates to rise above inflation for years