Anthony Quirk

|

Wednesday 4th October 2006 |

Text too small? |

The US currently has a significant trade deficit but has traditionally received positive interest income. However, the US is now paying out more to foreign lenders than it is receiving for the first time in at least 90 years. It currently owes US$2.5 billion, a small amount in the context of the huge US economy but a trend that could quickly accelerate to New Zealand-type proportions if the US continues to rack up large trade deficits. This comes at a time when a weaker US dollar is actually helping their trade position, but clearly not enough!

Of course one country’s deficit is another country’s surplus and part of the western world’s deficit issue is oil related with the oil producing nations well in surplus. Even Russia has a 12% trade surplus currently. But this is not the full story with oil importers such as China and Japan still enjoying trade surpluses. These surpluses have to find a home and are partly being re-invested into increasing productive capacity, although in the case of China one could argue that over-investment may be going on there at present. This is a key reason why the Chinese Government is trying to slow its economy.

The surpluses are also going into investments around the globe and this is one of the factors behind global bonds doing so well recently (as well as the Kiwi dollar) as investors seek high yielding but safe investment areas. Thus we could continue to see a situation where western countries such as the US and New Zealand receive investor inflows from Asian countries which are generating surpluses. However, a deficit of New Zealand-like proportions cannot continue indefinitely.

Here are three possible scenarios that could resolve our current account woes.

1) a slow but steady rise in our country risk premium which means a gradual increase in our interest rates and the Kiwi dollar probably being kept artificially high. This would be a slow and painful economic death! Domestic demand would eventually fall from slowing economic growth and rising unemployment. This would, in turn, decrease demand for goods and services and so a gradual improvement in our trade balance would result.

2) a dramatic fall in the Kiwi dollar as foreign investors leave their NZ dollar investments in droves. This is what happened in Iceland earlier this year and would result in a savage adjustment with the collapse in the Kiwi meaning a dramatic increase in interest rates as the Reserve Bank of New Zealand (RBNZ) fought to keep imported inflation under control. This would lead to a domestic recession with exporters doing very well and so a readjustment to our deficit would occur. This scenario probably needs a catalyst such as a country credit downgrade combined with consistent current account deficits of over 10%.

3) New Zealanders start to save more rather than spending up large as they are currently. Recent Government moves in the savings area are a policy response to this. If successfully implemented they are a long-term solution to improving our current account deficit while also starting to wean New Zealanders off their current residential housing investment dependency.

Global Growth Slowdown Unfolding

A key reason that global bonds have performed strongly in September is the reality that the global economy is slowing down from historically high levels. Many indicators are pointing to this slowdown, including the OECD leading indicator which is significantly lower from levels earlier this year. This reflects downturns in the US, Europe and Asia. For example, in Germany growth expectations are lower as that country looks to increase its Value Added Tax by three percentage points to 19%. The attempted managed slowdown in China is underway with leading indicators in other Asian countries such as South Korea and Taiwan also reducing.

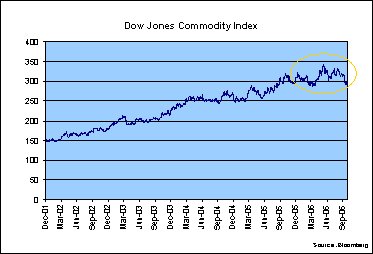

Investor perception of an imminent global economic slowdown provoked a savage adjustment in some commodity prices. The Commodity Research Bureau (CRB) index had its biggest drop since the 1974 recession! The oil price decline through the month was part of this, with crude oil prices 20% off their peak. Oil price hikes earlier in the year have been a tax on consumers and now a price fall might be a catalyst for a lower inflationary/higher growth scenario. Consumer and business sentiment indexes already seem to be reflecting a slight improvement from lower petrol pump prices.

Company responses will be interesting to note with some having experienced margin squeezes with oil price rises. The temptation must be, if market forces allow it, for these same companies to try to hold on to margins in the face of commodity price falls. Air New Zealand appears to be one obvious local example of this. It has been struggling to catch up with previous rises in its input costs and will now probably try to take its time in passing on the benefits of lower oil prices to its customers.

The silver lining to this is that global inflation pressures have eased. US inflation has probably peaked and is falling through Europe with the most recent monthly CPI readings all negative in Germany, Spain and Belgium. This is also being reflected in New Zealand. The latest National Bank Business Survey shows declining petrol pump prices have had an immediate effect on inflationary expectations and pricing intentions. The latter is now at a six month low – the sort of thing the RBNZ loves to see!

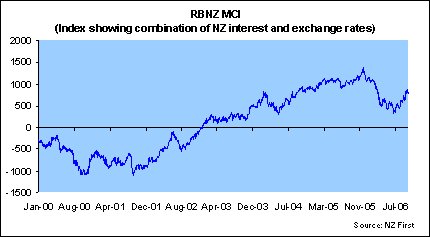

So Central Banks, particularly in the US, can now contemplate easing rates in 2007. In terms of the timing of this it seems that the Federal Reserve in the US is now more likely to cut rates earlier than the RBNZ. We would not have predicted this 6 months ago and is a key factor behind the recent resurgence in the kiwi dollar.

While it is decelerating the global growth outlook is still good with a soft landing still the most likely scenario. A moderate growth and inflation scenario is potentially the best of both worlds and bullish for both bonds and equities. Previously I thought it would be difficult for bond yields to go materially lower and help drive up equity valuations. However, lowering bond yields through September have helped sharemaket valuations. So while there are still many potential risks globally, the overall outlook is reasonably positive, although investment returns are very unlikely to match the levels of the past three years.

Commentary completed 2/10/06 Anthony Quirk - Managing Director of Tyndall Investment Management

Ph: (09) 377 7262 or 0274 895 568 anthony_quirk@tyndall.co.nz

No comments yet

GEN - Completion of Purchase of Premium Funding Business

Fletcher Building Announces Executive Appointment

WCO - Director independence determination

AIA - welcomes Ngahuia Leighton as 'Future Director'

Mercury announces Executive team changes

Fonterra launches Retail Bond Offer

October 29th Morning Report

BIF adds Zincovery to its investment portfolio

General Capital Resignation of Director

General Capital subsidiary General Finance update