|

Tuesday 23rd April 2024 |

Text too small? |

The buck stops

Global

The bulls were back in charge overnight with the Dow Jones jumping over 250 points while the S&P500 was back above 5,000 with a 0.9% gain. The Nasdaq jumped 1.1% ahead of a big week for earnings with several of the “Magnificent 7” mega-caps due to report. Nvidia rallied 4%. A broad-based rally was stoked by the view that geopolitical tensions are easing. Crude oil was flat as Iranian’s Foreign Minister said the country would not escalate the conflict with Israel. In the UK, the FTSE100 hit a milestone, going above 8,000 for the first time in history.

Easing geopolitical concerns have helped sentiment even as the persistence of inflation, along with the resilience of economy, are pushing out the timeline for Fed rate cuts. There will as a result be a lot of focus on PMIs, GDP, and inflation numbers out in the US in the coming days and ahead of the Fed’s meeting next week. A report overnight from the Chicago Fed showed March’s national activity index rising to +0.15, surpassing expectations and marking the highest reading since November.

The earnings season also stands as an important barometer of the general economic well-being, including the outlook for growth as well as pricing pressures. Around 40% of the S&P500’s constituents are set to report this week. Microsoft, Alphabet, Meta Platforms, and Tesla are all reporting. AI will likely be a big theme again.

Nvidia, while not reporting results this week, got a lift from reports that Japanese tech titan Softbank is planning to spend JPY150 billion (nearly US$1b) over the next two years on upgrading its computing facilities, which will involve procuring graphics processing units from Nvidia. Softbank is evidently using them not only to power its in-house large language models but will also offer access to them for any corporate clients needing a supercomputer.

Meta Platforms also edged higher. Mark Zuckerberg said the company was partnering with external hardware companies to build virtual reality headsets using the company’s Meta Horizon operating system. Apple has already launched its Vision Pro, and the move recreates the “Android versus iOS” dynamic in virtual reality headsets.

Continuing to be “not so magnificent” is Tesla. The shares fell over 3% to a 15-month low. The EV giant has slashed prices of its cars globally after its first-quarter deliveries fell for the first time in nearly four years. The company is fast losing its dominance in China where the price of a Model 3 has been cut by several thousand dollars, with prices for models in Germany cut by a similar amount.

It continues to be a very bumpy ride for Tesla with the stock down 40% year to date. There have been challenges on a multitude of fronts. The company’s robo-taxi is set to be revealed in August, but only after an 8-year wait (and no plans around infrastructure/regulatory approvals as yet). Much promised vehicle autonomy has yet to arrive. The company has also had to recall nearly 4,000 cyber-trucks due to potentially faulty break-pads. Plans to build a cheaper Model 2 car have evidently been cancelled, as was a much-vaunted meeting between Elon Musk and India’s Prime Minister Narendra Modi for an anticipated investment announcement. The company’s board is meanwhile trying to revive a US$56 billion payout to Musk that a court voided in January.

Some prominent bull analysts appear to be throwing in the towel, coming through with downgrades. Ark’s Cathie Wood believes still believes the shares (now US$142) could be worth US$2,000, while others have a price target less than a tenth of that. It is worth pointing out that even at the current market cap of US$450 billion, Tesla is still valued at nine times more than General Motors or Ford (up 6% overnight). Is there light at the end of the tunnel? Tesla is due to report on Tuesday, with forecasts for a 40% fall in operating profit and its first quarterly revenue decline in four years.

Elsewhere, telco Verizon shares fell as earnings beat expectations, but subscriber numbers fell. Salesforce shares rose while Informatica fell 10% as the data manager rebuffed take-over talk, saying it was not for sale. Trump Media shares fell. It has been revealed that former President Donald Trump is poised to receive up to US$1.25 billion worth of shares as part of an earnout. Shares in the owner of Truth Social have nearly halved since their debut in March.

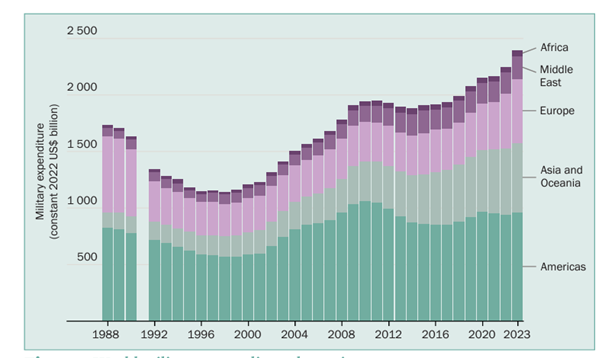

While geopolitical concerns may have moderated overnight, one thing that has not let up is military spending, which hit a record high of US$2.4 trillion in 2023, rising 6.8% from the previous year, according to a report from the Stockholm International Peace Research Institute. The Ukraine-Russia war, along with tensions in the Middle East, drove the jump. The US, China and Russia are the three biggest military spenders (interestingly India and Saudi Arabia round out the top five). This is not a new phenomenon. Military expenditure (at current prices) has been rising for nine years straight. World military spending per person is the highest since 1990, at US$306.

No comments yet

AIA - March 2025 Monthly traffic update

Ryman Healthcare FY25 full year results and webcast detail

CHI - Q1 2025 Operational Update

CNU - Q3 FY25 Connections Update

ERD - US Tariffs and EROAD's FY25 Results Date

April 15th Morning Report

Devon Funds Morning Note - 14 April 2025

April 14th Morning Report

Devon Funds Morning Note - 11 April 2025

April 11th Morning Report