IRG

|

Sunday 12th May 2013 |

Text too small? |

Delegat’s Group Limited is a New Zealand-based company. The Company is a producer of branded New Zealand wines for export and domestic markets. The Company is the producer and marketer of the Delegat's and Oyster Bay wines. The Company’s wines include Sauvignon Blanc, Chardonnay, Pinot Noir, Merlot and Sparkling wines. The Company’s segments include Delegat’s Wine Estate Ltd, Oyster Bay Wines Australia Pty Ltd, Delegat’s Wine Estate (UK) Ltd, Oyster Bay Wines USA, Inc., and other segments.

Delegat’s Group Limited is a New Zealand-based company. The Company is a producer of branded New Zealand wines for export and domestic markets. The Company is the producer and marketer of the Delegat's and Oyster Bay wines. The Company’s wines include Sauvignon Blanc, Chardonnay, Pinot Noir, Merlot and Sparkling wines. The Company’s segments include Delegat’s Wine Estate Ltd, Oyster Bay Wines Australia Pty Ltd, Delegat’s Wine Estate (UK) Ltd, Oyster Bay Wines USA, Inc., and other segments.

Performance

For the six months to 31st December 2012, a record operating NPAT of $19.2 million was generated compared to $17.4 million for the same period the previous year. Operating EBIT of $30.4 million is $2.1 million higher than for the same period in the prior year. Operating expenses (before NZ IFRS adjustments) at $42.4 million are $0.7 million higher compared to last year. Delegat's achieved Sales Revenue of $123.4 million on global case sales of 1.090 million in the six month period. Sales Revenue was up $4.4 million on the same period last year, due to global case sales being 7% higher. This increase was partially offset by adverse foreign exchange rate changes, which has contributed to case price realisation of $113.2, compared with the $116.4 achieved in 2011. Previously, Delegat’s announced for the year ended 30 June 2012, an operating NPAT of $25.6 million compared to $23.9 million last year. Operating EBIT of $43.5 million was $0.3 million lower than last year. Operating expenses (before NZ IFRS adjustments) at $77.1 million were $3.2 million lower compared to last year.

Recent Acquisitions

Delegat's Group Limited announced in January, 2013 that it has acquired the winery and vineyard assets of Matariki Wines Limited (In Receivership) and Stony Bay Wines Limited (In Receivership) for $8.5 million. The acquisition of this property meant Delegat's owns 20% of the prime Gimblett Gravels' appellation. With this acquisition Delegat's Hawke's Bay vineyard holdings increased to a total 500 hectares. Delegat's has over the last six months acquired two properties in Marlborough. In April, 2013 Delegat's Group Limited has entered into an agreement for sale and purchase to acquire the assets of Australian Winemaker Barossa Valley Estate Ltd (Receivers and Managers Appointed) for $A24.7million payable in cash.

Summary

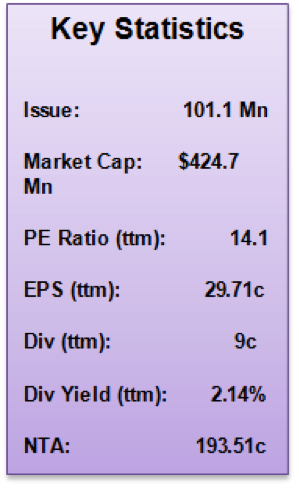

DGL reported Cash Flows from Operating Activities at $49.5 million and after further investments in vineyard development and winemaking plant led to a net reduction in borrowings of $29.0 million or 24%.The other financial highlights include the Group successfully improving profitability on a targeted reduction in case sales resulting in Operating NPAT of $25.6 million, up 7% on last year. Board was delighted to increase the full year dividend to 9 cents per share, an increase of 12.5% from the previous year. However, it is important to note that the New Zealand wine industry remains a long-term growth story. The industry continues to face some medium term headwinds, such as unfavourable exchange rates, duty and tax increases, particularly in the United Kingdom.

Despite those conditions Delegat’s recent acquisition should give them an opportunity to increase earnings in the future. The stock increased by 73.43% in the last one year period as reported by Financial Times.

No comments yet

Delegat's posts 62 percent gain in annual profit as value of vineyards, grapes increase

Delegat's confirms jump in harvest, IFRS harvest gains to lift FY net profit

Delegat's buys Australia's Barossa Valley Estate assets out of receivership for A$24.7M

Delegat's lifts first-half profit, selling more wine while keeping expenses in check

Delegats expands in Hawke‘s Bay

Jim Delegat loses suit against director of Salthouse Marine

Delegat's sees small lift in annual earnings, warns on strong currency

Delegat's FY profit falls 22 percent on lower harvest, drop in sales

Delegat's first-half profit reaches a record before non-cash writedowns

Delegat's expects $20m to $24m annual operating profit