IRG

|

Tuesday 16th July 2013 |

Text too small? |

The Summerset Group has grown consistently to become one of the country's largest and most respected operators in the retirement village and aged care sector. Summerset provides a range of living options to almost 2,000 residents across New Zealand. The company has a successful track record of developing and completing new villages, with 16 completed or in development from Warkworth to Dunedin.

Performance

Operational performance in 2012 exceeded IPO forecasts in all key areas. SUM posted an underlying profit of $15.2 million. This was an 88% increase on 2011 and 56% ahead of IPO forecast.Net profit after tax more than tripled that of 2011, and was a 12% increase on IPO forecast. Sales of occupation rights increased 43% on 2011, with new sales of occupation rights up 55% and resale of occupation rights up 33%. Summerset’s net operating cash flow was up 52% on 2011 and up 27% on IPO forecast, at $66.3 million. The strong cash flow performance was due to a higher realised gain on resales, a higher development margin and a strong operational performance.

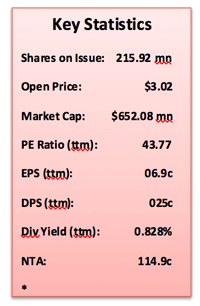

*Based on price on 15th July, 2013, 10:12 AM NZST

The Board declared a final dividend for 2012 of 2.5 cents per share, which was paid on 20 March2013. This was 25% above the amount forecast in the prospectus and reflects the strong performance of the company in 2012 and the confidence of the management going forward. SUM has established a dividend reinvestment plan to allow them to further their growth path. This gives shareholders theopportunity to reinvest dividends back into the company if they wish to.

Summerset's highly experienced senior management team is led by CEO Norah Barlow who is also the immediate past president of the Retirement Villages Association of New Zealand.

Outlook

Summerset has a strong development pipeline for future growth. Five villages are currently under construction, including the recently acquired site in Dunedin. Summerset also has three quality land sites in Karaka, Katikati and Hobsonville and is continually evaluating new sites to support the development of further villages based on demand.

In 2012, 160 retirement units were completed at four of Summerset’s developing sites –Hastings, Nelson, Dunedin and Warkworth. SUM now have 1,646 retirement units and 327 care beds. The company has also purchased two new sites in Auckland: 7.6 hectares of waterfront land in Hobsonville and a prime 3.9 hectare site at Ellerslie. These sites bring their land bank to 1,400 retirement units and more than 400 care beds.

Summerset’s 15th village, in Dunedin, was started mid-2012. The management expressed their satisfaction at the speed with which the village was delivered and accredited to the strength of their internal development capabilities. The management pointed out that this enables them to push retirement unit number delivery and gain greater control over cost, quality and speed. Development of the 16th village, Summerset by the Sea in Katikati, has already begun and the company expects to see the first residents move in midway through 2013.

The strengthening of development processes, along with additional banking facilities from their banking syndicate, resulted in SUM upgrading its long-term build rate to 300 retirement units per annum by the end of the 2015 financial year. Guidance given during IPO was for 250 retirement units per annum by 2016. An increased development margin of 12% from 6.2% in 2011 was a significant driver of underlying profit. The company also pointed out that they will not seek additional funds from shareholders to fund the increased build rate.

Investment Perspective

Summerset has been named best retirement village operator in Australasia for the third year in a row (2010, 2011, and 2012) and also managed to enter the NZX 50 Index in December 2012. In 2012 an increased development margin of 12% was a significant driver of earnings. Summerset’s development capability – enhanced by the ongoing internalisation of development and design – has enabled the company to increase the rate of retirement unit delivery and gain greater control over quality and speed of delivery. Given, the company has managed to secure adequate land bank for their immediate future needs this internalization of development and design will help to fuel the earnings growth.

Despite the rapid growth and the favourable results, Summerset did not have a high increase in its debt. Debt only increased marginally from $69.12 million to $78.16 million. This can be a sign indicating that the cost control measures that management has implemented are working well. Obviously these are early days, but signs and demographic trend indicates favourable growth prospect for Summerset.

There is some setback for Summerset as the consent for Hobsonville development was rejected by Auckland Council. SUM has appealed that decision and the implementation of the changes currently being considered for the Resource Management Act.

Despite the above, Summerset is backed by the future needs of the strong demand of aged care sector and have delivered strong results. The stock is rated “outperform” according the analyst consensus as reported by Reuters and have increased 73.01% in one year.

No comments yet

MPG - Metroglass clarifies media statements by Crescent Capital

VTL - Takeovers Panel orders Empire to reimburse Vital's expenses

March 14th Morning Report

SKT - Sky secures iconic sports rights

RYM - Ryman completes Retail Entitlement Offer

TEM - Transaction in Own Shares

FPH launches F&P Nova™ Nasal mask in NZ and AU

Fonterra announces changes to management team

March 12th Morning Report

WHS FY25 Interim Results teleconference details