by wise-owl.com

|

Monday 17th September 2007 |

Text too small? |

How normal are corrections?

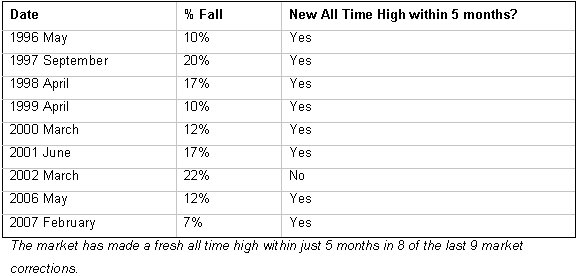

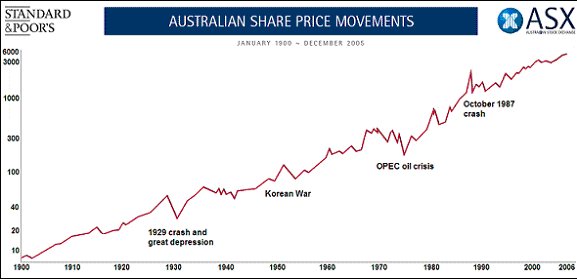

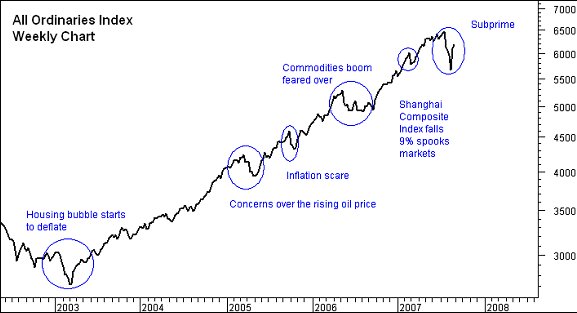

Corrections go hand in hand with investing in share market. From 1996 to 2001 there has been a correction every year of 10% or more. Following steady trading in the years 2002, 2003 and 2004, the market went on to face falls of more than 8% every year since. While corrections may sound gloomy, they are yet to halt the stock markets long term trend which is very clearly up. Looking at a 100 year chart of our market’s fortunes shows that long term investors have always been rewarded.

Over the last 100yrs, the Australian share market has consistently broken into fresh all time highs. Source: ASX.

But surely the current market correction is much worse than the last one right?

Surprisingly it’s not. As you’re watching your trading screen or the news at night, every correction feels more intense and serious than the last. At least until hindsight kicks in anyway! Before you know it, time passes, markets calm and you find yourself pondering what a great buying opportunity that last correction was, and of course, how you’ll be a buyer the next time such an opportunity presents itself. In the current conditions, we can all relate to how this is easier said than done.

What has often separated those working on their first million from those working on their next billion is the ability to be a buyer when others are panicking. It goes against every instinct to work against the crowd, but buying quality positions when others are rushing to sell can be very rewarding to the long term investor. Usually the biggest change in a market before and after a crash is sentiment. However, the fears that drive market falls tend to be unrealised.

How bad is subprime?

While the subprime situation warrants monitoring, markets seem to have over reacted. Many stocks are priced for a doomsday scenario that is unlikely to unfold. The best estimate of subprime losses we have on hand is the estimated US$100 billion of losses that Bernanke cited. This may sound like a lot, but in the US$10 trillion dollar United States mortgage market it is merely a drop in the ocean, representing only 1% of mortgages.

In Australia, the main companies at risk are those that rely on wholesale debt markets for survival such as RAMS Home Loans or Hedge Funds that have invested in subprime securities. As banks are able to source funds for lending from depositors they are unlikely to be affected by the subprime fallout.

The market has a colourful history of overreacting. The triggers of recent market corrections have never had the devastating impact that was initially expected.

Were the fears of recent corrections realised?

Not yet! Going through recent corrections, the fears did not live up to what eventuated.

So what’s driving this sell off? Market Psychology Textbooks on the market suggest that people are rational, and that markets will always reflect facts, not fads or mood swings. So in theory bubbles and crashes should never occur.

But they do occur, and explaining them is a work in progress. The best explanations are coming from a school of thought called behavioural finance. Most of us know that personally, we are normal and rational investors, but as for that person sitting next to us…. well lets just say he tends to get caught up in the mood of the moment! Let’s face it, people are often not rational, and more often than not make decisions based on emotion or gut feel. Facts can easily take a back seat.

To make matters worse, the more uncertain any situation becomes, the more people tend to follow the crowd as it creates a feeling of safety

Unfortunately, when it comes to financial markets, this life saving instinct tends to be very expensive. When some shareholders start selling, the herd instinct can encourage other investors to start selling as well, often in fear that someone else knows something they don’t. Before you know it everyone tries to sell and you have a crash on your hands.

Now, this often creates great buying for the astute investor, who knows that more often than not the sell down has more to do with sentiment than facts.

The current market correction is a buying opportunity While we expect that soft trading conditions could persist for a little longer, this is unlikely to be the start of a bear market. History has shown that markets usually bounce from corrections within months, often to then reach a fresh all time high. Supporting this scenario is a global economy that remains very strong. Should any weakness in the US economy become apparent, it should be made up for by the strength we’ve seen in Europe, Japan, India and China.

The US economy, while important is becoming less important as a driver of the global economy. For the first time in history, the absolute growth in the Chinese and Indian economies is set to exceed that of the US economy this year. Importantly these economies are much less dependant on the US economy for their growth, as they have growing levels of domestic consumption and export goods globally.

The closest parallel in history would be the industrialisation of Japan which in part contributed to the economic boom of the 1970’s. At that time, Japan accounted for 2% of the world’s population. That boom lasted for 15 years.

China and India today account for a staggering 36% of the world’s population, and we are only 5 years into the current boom. The industrialisation of so many people at the one time is unprecedented in scale, and set to support global growth for many years to come.

With this in mind, and the tendency for markets to bounce back from overdone falls, is the US subprime situation likely to be the beginning of the end? Or is the global economy simply in the first chapter of the largest industrialisation induced growth phase we’ve ever seen?

No comments yet

MWE - Suspension of Trading and Delisting

EBOS welcomes finalisation of First PWA

CVT - AMENDED: Bank covenant waiver and trading update

Gentrack Annual Report 2024

December 20th Morning Report

Rua Bioscience announces launch of new products in the UK

TEM - Appointment to the Board of Directors

December 19th Morning Report

RAD - Radius Care Announces On-market Share Buyback Programme

MCY - New wind farm propels MCY renewables commitment to $1b