|

Monday 5th March 2007 |

Text too small? |

Two recent examples are the discovery of a major gold deposit in Peru in the 1990’s by Canadian junior Arequipa Resources. The La Pierina discovery was world class with resources of over 7 million ounces of gold. Between October, 1995 and end of October 1996, when it was bought out by Barrick, Arequipa shares rose from $1.15 to $30.00. And it wasn’t a scam!

More recently another small Canadian explorer discovered what promises to be a world class gold deposit in Ecuador. The following graph tells the story for the happy shareholders since the announcement of the first drill hole results!

Aurelian Resources Discovery in Ecuador and the impact on share prices

Aurelian Resources Discovery in Ecuador and the impact on share prices

So clearly exploration can generate great returns – that is if the exploration programme is well-conceived, adequately funded, and staffed by experienced personnel. Major new discoveries are mainly going to be made in areas which have not been intensively explored in the past and this means additional risks. For example the discovery of a world class copper-gold deposit in Mongolia recently prompted the government to change the rules which significantly reduced the prospective returns from mining.

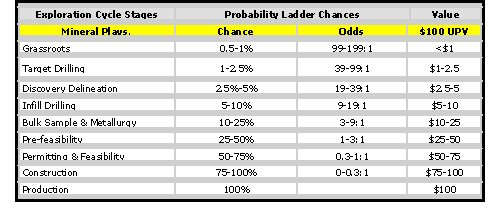

The exploration odds for any mineral exploration programme have been quantified by John Kaiser and are reproduced in the following table.

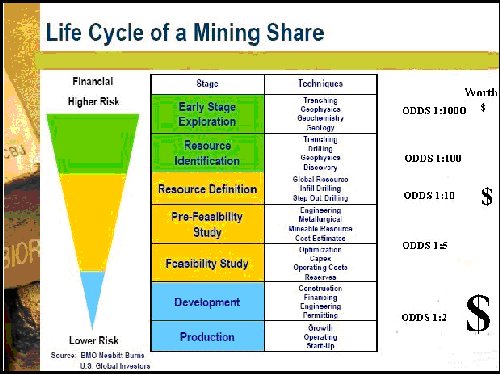

The following chart shows how the risk decreases and the value increases through the various stages from exploration through discovery to development of a typical resource.

This figure shows how risk decreases but value increases as a property advances from grassroots to become a mine. (Modified from BMO Nesbitt Burns)

Usually the value of a discovery, and hence the share price, increases steadily as the risk profile reduces. The problem for investors in mining shares is to determine when the potential rewards in the share price exceed the attendant risk. The mining business is infamous for investor scams and hype and it is often difficult to separate the ‘gold from the dross.”

Nevertheless there are very few investment sectors which offer the excitement and the rich rewards of the mining business.

The authors of this article, and producers of the Mining Investor are two NZ geologists Peter Roberts & Dr Ray Merchant.

The Mining Investor is a subscriber-based newsletter and examples of the newsletter can be downloaded at www.mininginvestor.co.nz

The Good Returns online Bookstore now also has two TOP books available for resource investors:

- Top Resource Stocks 2007 (Be quick! Previously the shipment has sold out within days of arriving)

- The Insiders Guide to Investing in Aust. Mining & Resources Stocks

No comments yet

Devon Funds 2025 Predictions

Synlait HY25 results date and conference call details

CVT - Update on Accounting Irregularities

Tower Updates FY25 Guidance

February 5th Morning Report

MEL - Tauhei Solar Farm Power Purchase Agreement

TRU - TruScreen Appoints Indonesian Distributor

CRP - Korella North Mine looks to export through Port of Karumba

General Capital subsidiary General Finance update

Devon Funds Morning Note - 24 January 2025