|

Wednesday 1st July 2015 |

Text too small? |

But the ministers said they would discuss a last minute suggestion from Greece for a new bailout programme.

Greece is the first advanced country to fail to repay a loan to the IMF and is now formally in arrears.

There are fears that this could put Greece at risk of leaving the euro.

The IMF confirmed that Greece had failed to make the payment, shortly after 22:00 GMT on Tuesday.

"We have informed our Executive Board that Greece is now in arrears and can only receive IMF financing once the arrears are cleared," said IMF spokesman Gerry Rice.

With the eurozone bailout expired, Greece no longer has access to billions of euros in funds and could not meet its IMF repayment.

Eurogroup chairman and Dutch Finance Minister Jeroen Dijsselbloem earlier said it would be "crazy" to extend the Greek bailout beyond its Tuesday midnight expiration as Athens was refusing to accept the European proposals on the table.

Speaking after the conference call with other eurozone ministers, he added that a Greek request for a new €29.1bn European aid programme would be considered later.

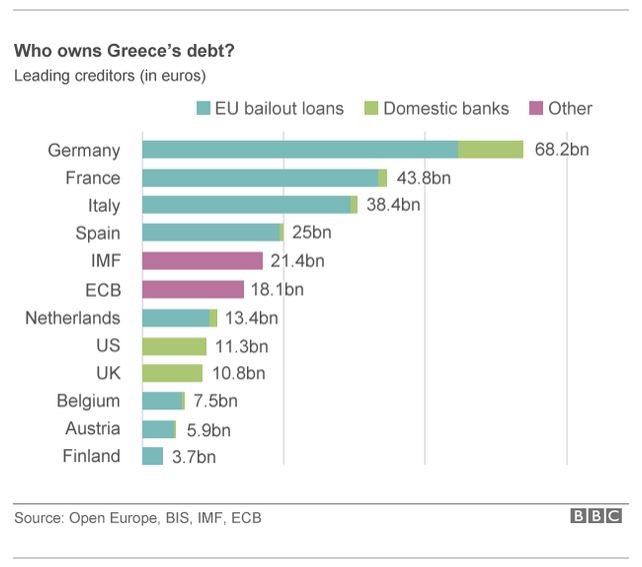

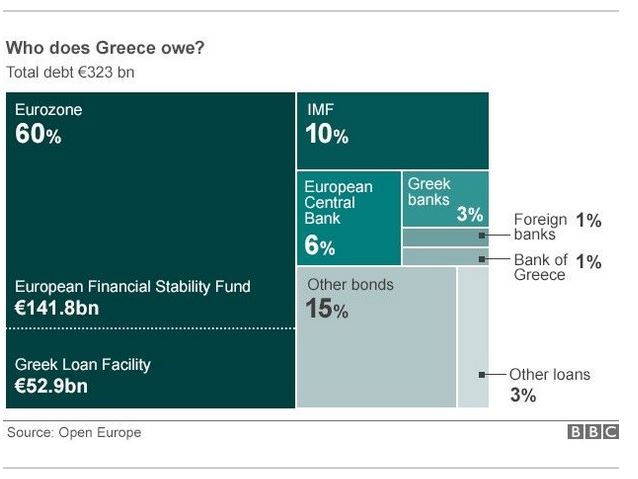

The European Commission - one of Greece's "troika" of creditors along with the IMF and the eurozone's European Central Bank - wants Athens to raise taxes and cut welfare spending to meet its debt obligations.

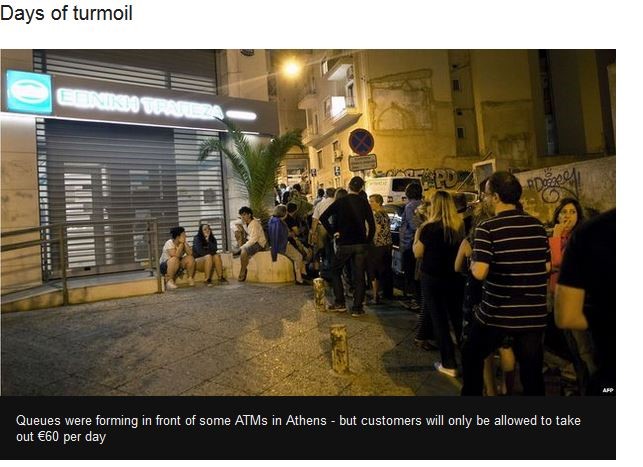

Amid fears of a Greek default on its huge public debt of €323bn, people have queued at cash machines. Withdrawals are capped at just €60 a day.

Greek banks did not open this week after talks between Greece and its creditors broke down. However, up to 1,000 bank branches will re-open from Wednesday to allow pensioners - many of whom do not use bank cards - to withdraw up to €120.

Analysis: By Andrew Walker, economics correspondent

The sky will not fall in now the deadline for Greece to repay to the IMF has passed, but the tension will rise.

When a payment to the IMF is missed and managing director Christine Lagarde informs her board, the eurozone would have the right under the loan agreements to demand immediate repayment of more than €180bn they have already lent Greece, together with interest.

Failure to repay the IMF comes under a list of "events of default" set out in the legal documents. IMF officials say Ms Lagarde intends to inform the board promptly if Greece doesn't pay on time.

Of course, in practice, the rest of the eurozone won't demand the money back and send in the bailiffs. Athens couldn't possibly repay and in any event they want to keep talking, hoping they can keep Greece in the eurozone. But the fact that they would have the option is a sign of how close Greece is getting to the brink.

On Tuesday evening, thousands of pro-EU protesters braved stormy weather and gathered outside the Greek parliament in Athens to urge a "yes" vote in a referendum on Sunday over whether the country should accept its creditors' proposals.

It follows a similar demonstration by those advocating a "no" vote - the path preferred by Mr Tsipras - on Monday.

EU leaders have warned that a no vote rejecting creditors' proposals would mean Greece leaving the eurozone - though Mr Tsipras says he does not want this to happen.

The ECB is believed to have disbursed virtually all of its emergency funds for Greece, amounting to €89bn (£63bn).

01:00 Greek time Wednesday (22:00 GMT): Greece's €1.6bn repayment to the IMF is due.

5 July - the referendum on creditors' proposals, and many say Greece's membership of the eurozone, takes place.

20 July - Greece must redeem €3.46bn of bonds held by the European Central Bank. If it fails to do so, the ECB can cut off Greece's access to emergency loans.

Lenders' proposals - key sticking points

No comments yet

SKC - FY26 Half Year Result Teleconference Details

January 22nd Morning Report

TGG - FY 2025 Earnings Guidance Update

Meridian Energy monthly operating report for December 2025

January 21st Morning Report

PEB - Q3 26 Results and Key Strategic Milestones

FBU - Fletcher Building announces sale of Fletcher Construction

A thank you from Stuff's owner and publisher

FPH Appoints New Director and Future Director

January 19th Morning Report